A structured investment product that combines a time deposit and a foreign currency option

Minimum Investment Amount

Variety of choices

Application Requirements

- Age 18 or above

- Macau permanent citizen

- Investment accountholder of our Bank

Features

- Available Tenor ranging from 7 days to 6 months.

- Currencies for your choice include HKD, USD, AUD, NZD, EUR, GBP, CAD, JPY and CHF.

How it works

Currency pair HKD/NZD

|

Currency-linked Contract (CLC) |

|---|---|

| Deposit currency | HKD |

| Principal Amount | $550,000 |

| Linked Currency | NZD |

| Investment Tenor | 31 days |

| Value date | 18 March, 20XX |

| Strike Rate* | 5.4964(i.e. NZD1 =HKD5.4964) |

| Exchange Rate Fixing Date /Maturity Date | 18 April, 20XX |

| Interest Rate (p.a.)^ | 15.21% |

| Value at Maturity Date@ | If the Fixing Rate is at or above the Strike Rate (i.e.5.4964), |

* Spot exchange rate is 5.5159 (i.e. NZD1=HKD5.5159)

^ This is expressed in an annualized format and is based on the hypothetical assumption that the CLC (HKD as “Deposit Currency”) can be rolled over on the same terms for a period of 365 days. It does not reflect the actual Rate of Return of the CLC for the Investment Tenor. You should not rely on the Interest Rate in an annualized format as an indication of the expected return for the CLC.

@ All calculation results are rounded to two decimal places.

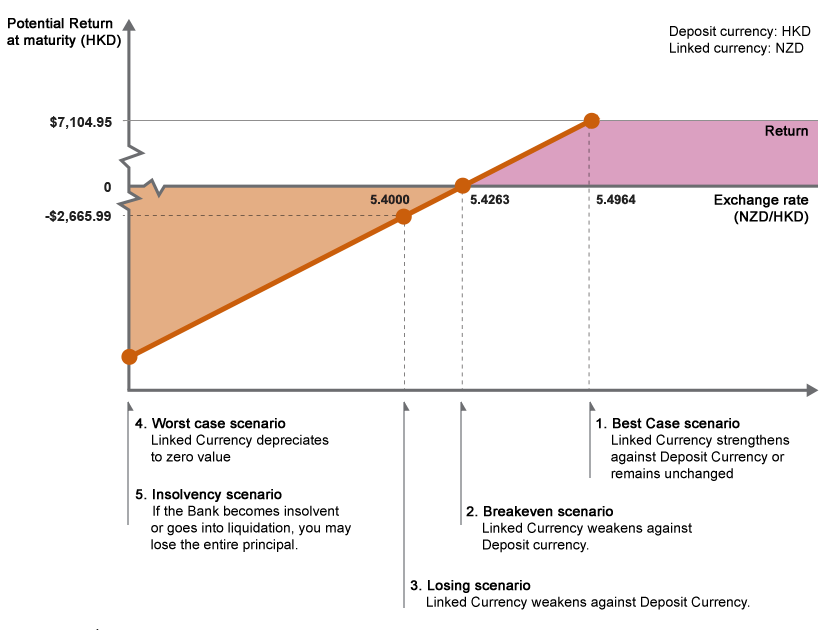

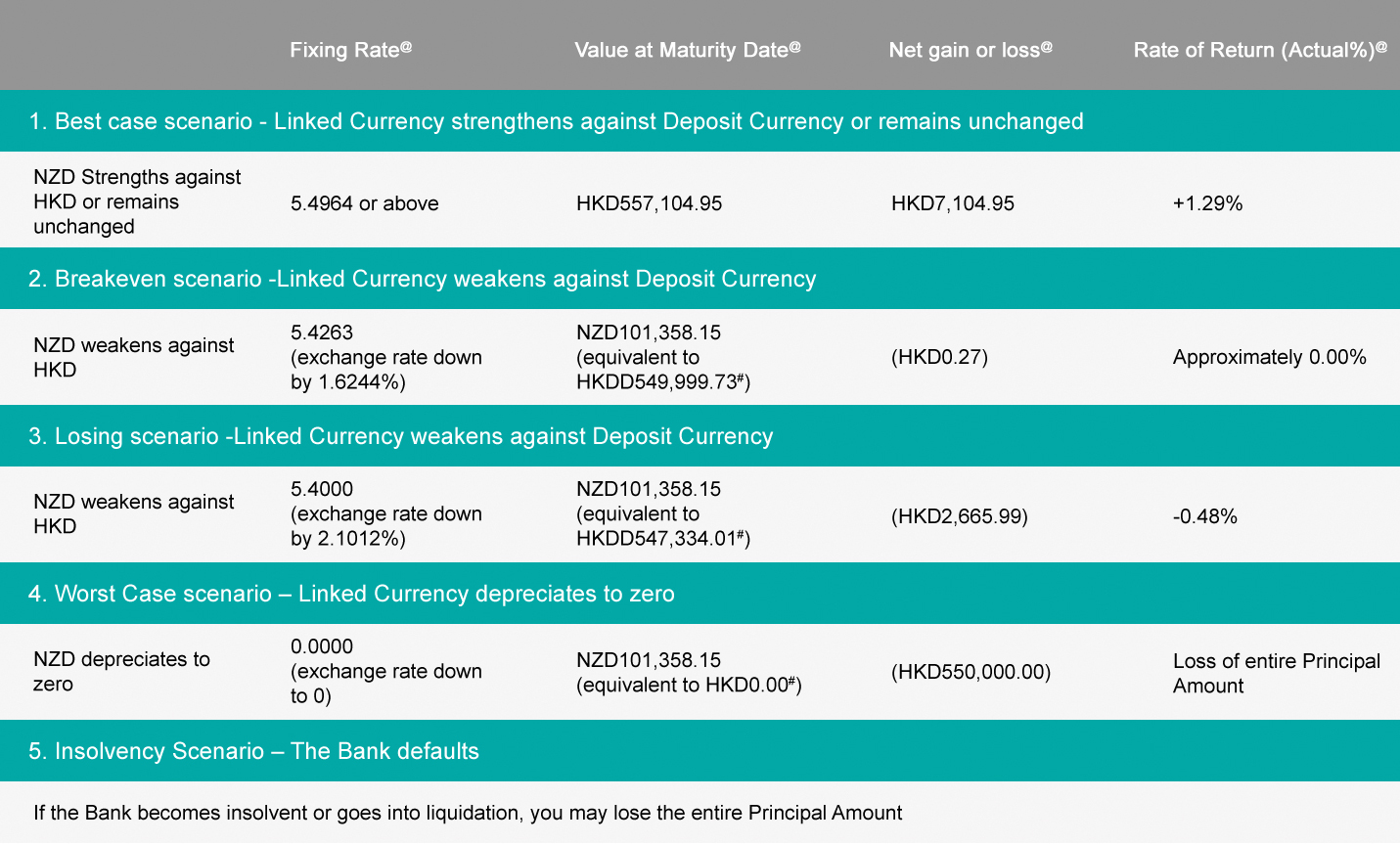

Potential Return of Currency-linked Contract under Different Scenarios

Return analysis:

# Equivalent amount in HKD = NZD (P+I) x Fixing Rate

@ All calculation results are rounded to two decimal places except for the decreases in percentages of the exchange rates, which are rounded to four decimal places.

Declaration

The illustrative examples above are hypothetical and provided for illustration purpose only. The above scenarios are not based on the past performance of the Linked Currency against Deposit Currency and do not represent all possible outcomes or describe all possible factors that may affect the return for investing in our CLC. The Bank is not making any prediction on future movements of the exchange rates between Linked Currency and Deposit Currency by virtue of providing the illustrative examples. The scenarios assume no fees and charges.

Visit our branches with required documents for account opening.

BranchesImportant Notice and Risk Disclosure

- Currency-linked Contract is a structured product involving derivatives. It is not equivalent to traditional Time Deposit and should not be considered as a substitute for Time Deposit.

- Foreign currency-denominated transactions involve currency risks and may result in significant losses. The return of Currency-linked Contract depends on the FX market condition on the Exchange Rate Fixing Date. Fluctuations in currency rates of the linked currency may result in significant losses in the amount invested. The investor cannot withdraw the principal amount before maturity. The contract should be held to its maturity.

- The above information is for information purpose only and is not an offer, a solicitation of an offer, or any advice or recommendation to enter into a transaction. You should seriously consider if the relevant investment product is suitable for you before making any investment decision.