Principal protection1 and potential interest enhancement!

It is a structured investment product that embeds foreign currency option. You can have your principal protected1 and grasp the investment opportunities with a higher potential interest return in response to foreign exchange movement.

How to apply

Warning Statement

Currency Pair Principal Protected Investment is an unlisted structured investment product involving derivatives. Investment involves risks. The investment decision is yours, but you should not invest in this product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

Currency Pair Principal Protected Investment is NOT protected deposit and is NOT protected by the Deposit Protection Regime in Macau. It is NOT equivalent to nor should it be treated as a substitute for a traditional fixed deposit.

100% principal protection1

Receive 100% of the principal amount upon investment maturity regardless of currency movement1

Potential higher interest return

Potential higher interest returns in response to the trend of the foreign exchange movement

Choice of Bullish or Bearish view

Capture the foreign exchange movement by adopting a bullish or bearish strategy

No currency conversion

Get back your return in the currency of your investment at maturity

Tailor-made to suit your needs

Tenor varies from 3 to 12 months, and offered in a wide range of currencies, subject to your needs

No Extra Handling Charge2

Remarks

- Principal protection is only applicable if this product is held to maturity, subject to the credit and insolvency risks of the Bank and the Currency Pair Principal Protected Investment Terms and Conditions.

- Subject to the Currency Pair Principal Protected Investment Terms and Conditions.

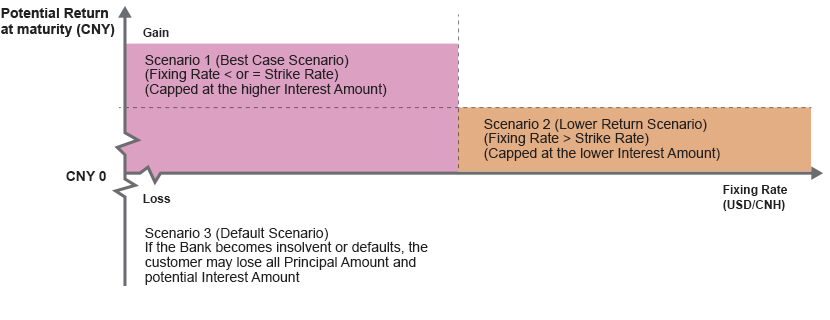

How it works

Declaration

The illustrative examples above are hypothetical and provided for illustration purpose only. They do not reflect a complete analysis nor all possible factors of all possible potential gain or loss scenarios, are not based on the past performance of the exchange rates of the Currency Pair and must not be relied on as an indication of the actual performance of the exchange rate of the Currency Pair or this product. You should not rely on these examples when making an investment decision. The scenarios assume no fees and charges.

Related offering documents and links

Visit any of our branches for account opening.

BranchesImportant Notice and Risk Disclosure

- This product is not a protected deposit and is not protected by the Deposit Protection Regime in Macau,not equivalent to nor should they be treated as a substitute for fixed deposit.

- The principal protection feature of this product is only applicable if this product is held to maturity and subject to the credit and insolvency risks of the Bank and the relevant terms and conditions.

- Investment in this product is not the same as buying any currency of the Currency Pair directly. This product is not secured by any collateral, hence no first priority of claim to the proceeds of the collateral realized. Investors have to bear the credit and insolvency risks of the Bank, and you could lose all of your investment. There is no liquid secondary market for this product, and the Bank has the right (but not the obligation) to terminate this product early upon occurrence of certain events.

- Foreign currency-denominated transactions involve currency risks. Fluctuations in currency rates may result in significant losses in the amount invested in the event that the currency denominated in the transaction is exchanged to another currency.

- If the investment involves Renminbi, you should note that the value of Renminbi against other currencies fluctuates and will be affected by, amongst other things, the PRC’s government control. You should also note that Renminbi is currently not freely convertible and the offshore Renminbi exchange rate may deviate significantly from the onshore Renminbi exchange rate.

- The illustrative examples given in this webpage are given as an indication only and should be read subject to the offering documents governing this product (including but not limited to the Currency Pair Principal Protected Investment Terms and Conditions, the Investment Account Terms and Conditions the relevant Term Sheet), and are you advised to read and understand the terms and conditions of the offering documents (including but not limited to the Currency Pair Principal Protected Investment, the Investment Account Terms and Conditions and the relevant Term Sheet) before investing in this product.

- The content in this material is not and shall not be considered as a recommendation, offer or invitation to purchase or subscribe any of the investment products or services mentioned herein. This material does not represent all the details of the risk and product. Investor should not invest solely based on this promotional material. You should carefully read the offering documentation for a detailed product information and risk factors prior to making any investment decision. If you have any doubt, you should seek independent professional advice.

- This promotional material is prepared by OCBC Bank (Macau) Limited, and the contents have not been reviewed by any regulatory authority in Macau.

- In case of discrepancy between the English version and the Chinese version, the Chinese version shall prevail.